We assist business owners to

build a legacy

retire

make an impact

by creating passive income with real estate!

We assist business owners to

build a legacy

retire

make an impact

by creating passive income with real estate!

STOP RELYING ON YOUR BUSINESS FOR INCOME!

Ready To Learn More & Avoid An Investment Nightmare? Get your free Ebook “100 Questions Business Owners Ask Before Investing”

- Passive income direct to your bank account

- Limited exposure to market volatility

- Investments secured by real estate

- Recession insulated opportunities

- Consistent lucrative returns

Why Entry Level Housing?

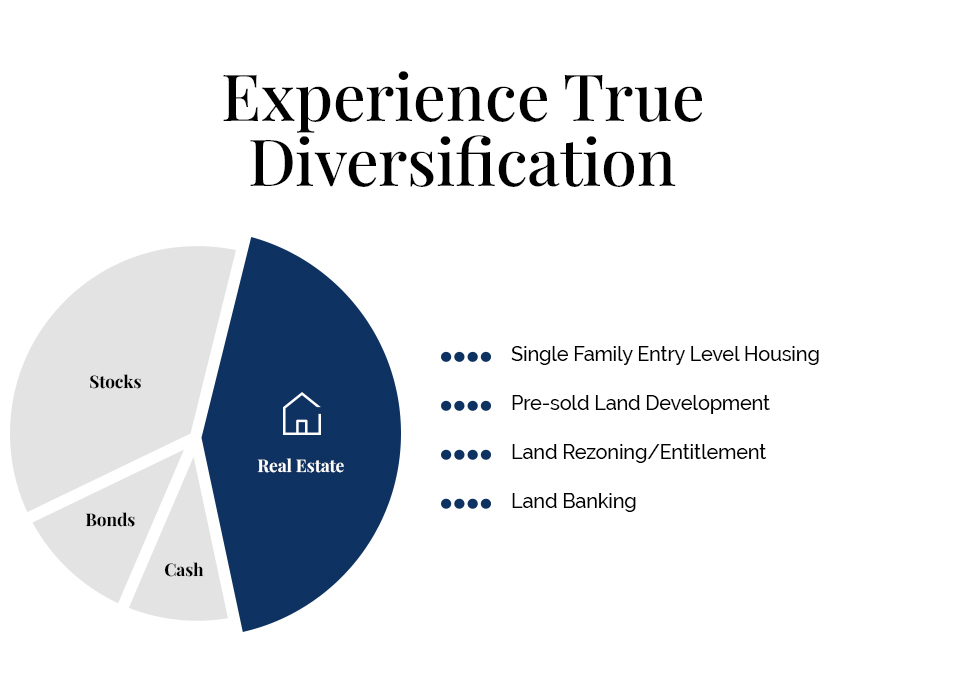

Real estate is critical to a strong investment portfolio. Thanks to its low correlation to stocks and bonds, entry level housing real estate provides reduced exposure to market volatility and enhanced returns.

Passive Income

Our investment opportunities provide solid cash-on-cash returns and are completely passive with our investors.

High Demand

Over 33% of the home buying population is seeking to buy their first home and can’t find something affordable.

Superior Returns

Our portfolio has delivered healthy double-digit returns and is a fantastic hedge against inflation.

Low Supply

Less than 10% of homes being built are affordable to first time home buyers.

Passive Ownership

HBG Capital provides completely passive opportunities to invest in institutional quality assets.

Stable Asset

With incredible demand and limited supply, entry level housing assets are one of the most sought after assets in the US.

How We Change Lives

About Us

How It Works For Our Investors

1

Request Invitation

- Speak with us about your background, experience, and investment goals.

2

Browse Past Opportunities

- Familiarize your self with past Investment opportunities & take advantage of our knowledge center.

3

Attend New Investment Release

- We will will invite you to attend when we have something that fits your investment criteria.

4

Fund Investment

- Place capital in opportunities that are a fit. We will do all the heavy lifting while your capital is working for you.

Fast track your learning, reduce avoidable errors, and accelerate your progress towards financial goals.

Recession Resistant Real Estate Radio is engineered to help business owners make better financial decisions, grow their business, and make an impact while having fun doing it!

In this show, we go deep into real estate, passive investing, and business growth strategies so you can build your legacy, achieve financial freedom, and impact those around you!

FAQ's

$50,000

Single Family Entry level housing communities. Pre-sold Land development to national home builders. Land banking in areas with significant surrounding development.

Nashville, TN and the surrounding areas.

We work with both.

Being an accredited investor allows you access to investment opportunities that are not available to the general public. According to the SEC, an individual accredited investor is defined as a person who has earned over $200,000 individually or $300,000 jointly with a spouse in the past two years and expects the same for the current year, or someone with a net worth exceeding $1 million alone or combined with a spouse, not counting the value of their primary residence.

We provide our investors with access to a state-of-the-art investor portal. Here, you can check the status of your investment, view detailed investor reports, and track your returns in real time.

We issue detailed investor reports on a monthly basis, providing updates on the performance of our assets, market trends, and any changes in our strategic approach.

Real estate is typically a long-term, illiquid investment. Most of our investment opportunities have a projected hold period of 1 to 3 years. While we strive to provide opportunities for liquidity events but it’s important to consider this illiquidity when investing.

Yes, many of our investors choose to invest using their self-directed IRAs, ROTH’s, or 401(k)s. It’s a smart strategy to grow your retirement savings and take advantage of the tax benefits. If you need assistance with this process, our team can recommend several custodians we have long standing relationships with. However, we recommend consulting with your tax advisor or financial planner before making an investment.

Our experienced team takes a hands-on approach to management. If a property isn’t performing as expected, we reassess our strategy and make necessary changes to improve performance. This might include operational adjustments, capital improvements, or restructuring the property’s debt. In any instance, we make it our priority to communicate with investors immediately about any change to the business plan or return projections.

Our accounting firm provides all investors a k-1 via the investment portal. We notify inventors of all new document uploads to the portal via email.

Copyright © 2024 - HBG Capital - All Rights Reserved.